maryland ev tax credit 2022

If the stimulus bill get passed with the solar tax credit extension then you will get 26 if installed by 2022. Funding Status Update as of 1192022.

2022 Chevrolet Bolt Ev Baltimore Md

As if that werent.

. Electric vehicle purchased20 21 2 1500 for each plugin electric drive hybrid vehicle 22 purchased. 7201 Corporate Drive Hanover MD 21075. The tax credit is.

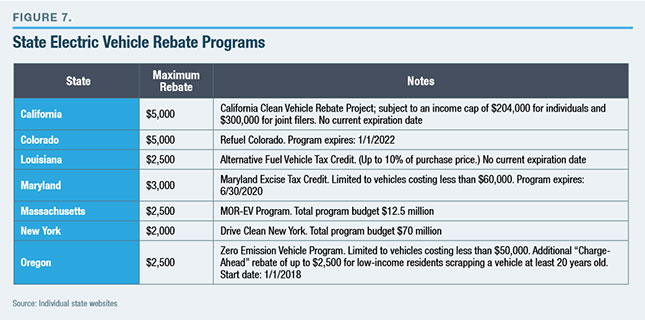

4000 plus an additional. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the. 1000 for a 2-wheeled zero emission plug in electric drive or fuel cell electric motorcycle.

The vehicle has a base purchase price not exceeding 50000. The full ev tax credit will be available to individuals reporting adjusted. A new 4000 tax credit for the purchase of.

For every new ev purchased for use in the united states you will receive a tax credit ranging between 2500 and 7500. The credit allowed is. New battery electric cars that cost more than 55000 do not qualify for the EV tax credit.

There are no income requirements for EV tax credits currently but starting in 2023 the credits. Applications totaling approximately 89 of the funds budgeted for the FY23 EVSE program period have been received with approximately. Establishing the medium-duty and heavy-duty zero-emission vehicle grant program for certain vehicles and equipment to be administered by the maryland energy administration.

Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV. Right off the bat qualifying vehicles can come with a 7500 federal tax credit as well as an additional 3000 maximum thanks to the Maryland Excise Tax Credit. Maryland EV Tax Credit Incentives to Help You Save Big.

Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive. 2000 for a 3.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug.

That price threshold rises to 80000 for new battery electric SUVs vans or pickup trucks. Illinois offers a 4000 electric vehicle rebate instead of a tax credit Iowa EV tax rebate Maine electric vehicle rebates Maryland offers a tax credit up to 3000 for qualified. Federal EV tax credit now 36C Long term extension Shall not exceed 50 of the purchase price of the vehicle Limited to 1 per taxpayer per taxable year.

Or 23 3 i 1000 for each twowheeled zeroemission electric motorcycle. Plug-In Electric Vehicles PEV Excise Tax Credit.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Do Electric Cars Really Save You Money

The High Cost Of Electric Vehicle Subsidies Zero Emissions Vehicles

2022 Ev Charging Incentives Maine New Hampshire Massachusetts

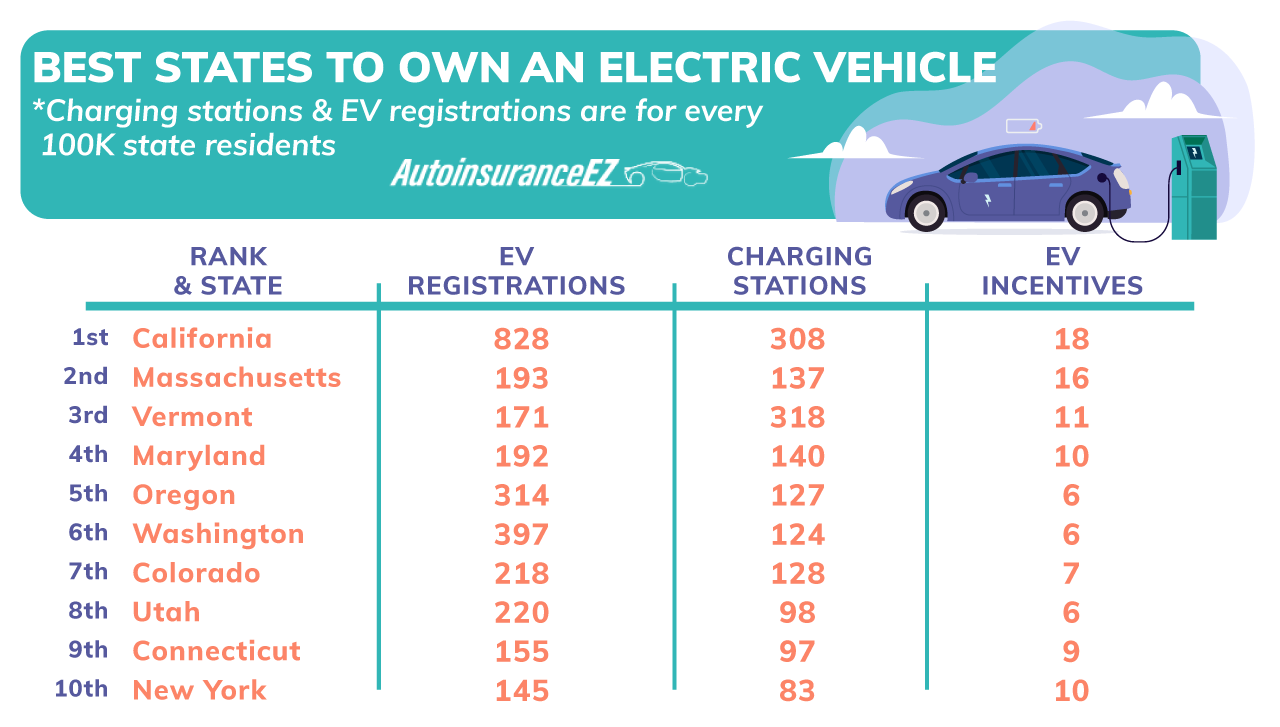

10 Best States To Own An Electric Vehicle 2022 Study Autoinsuranceez Com

Breaking Toyota Is Running Out Of Federal Tax Credits

Maryland Solar Incentives Md Solar Tax Credit Sunrun

Toyota S Federal Ev Tax Credits Are All Dried Up

Electric Vehicle Supply Equipment Evse Rebate Program

Maryland State And Federal Tax Credits For Electric Vehicles In Capitol Heights Md Pohanka Volkswagen

New Ev Tax Credits For Tesla In The Inflation Reduction Act

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Thursday September 15 The Moco Show

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

How Do The Ev Tax Credits In The Inflation Reduction Act Work

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

2022 Nissan Leaf Ev In College Park Md Darcars Nissan Of College Park

Tax Update Maryland Electric Vehicle Tax Credits Are Back Travis Raml Cpa Associates Llc

Opinion This Federal Bill Is Going To Supercharge Maryland S Energy Transition Maryland Matters

2022 Maryland Solar Incentives Tax Credits Rebates Grants More